A simple program (Yes, this webpage is a .ipynb file!)

The goal of this notebook is to illustrate basic finance computations within a markdown document. There is an analogous .py file, whose results have to be logged. Then, to produce output, you'd have to copy and paste key output into a Word document. This notebook does both at once!

The point of this notebook is ONLY illustration! Pay attention to its structure and flow, and get an early glimpse of just a little bit that we can do with pandas, seaborn, and a few other packages.

First, we start by importing key packages...

The core Python language is quite small (nimble and easy to maintain), so we add functionality by using external packages. The import calls should always be at the top of your code!

If you want to run this code (and you should try!)

- Download the raw raw unrendered ipynb file here called "02a-a-simple-program.ipynb". On Chrome and Firefox, you simply right click the file name and select "Save Link As". Put the file in the same folder with the file you're working on already and then open it in Jupyter.

- Open a new/second terminal/powershell and type

pip install pandas_datareader - Click the "Kernel" menu above, then "Restart & Clear Output". Now all the results below will disappear.

- Click the "Cell" menu above, then "Run All"

import pandas as pd

import numpy as np

import pandas_datareader as pdr # you might need to install this (see above)

import matplotlib.pyplot as plt

import seaborn as sns

import statsmodels.api as sm

stock_prices = pdr.get_data_yahoo(['AAPL','MSFT','VZ'], start=2006)

stock_prices = stock_prices.filter(like='Adj Close') # reduce to just columns with this in the name

stock_prices.columns = ['AAPL','MSFT','VZ']

daily_pct_change = pd.DataFrame()

for stock in ['AAPL','MSFT','VZ']:

daily_pct_change[stock] = stock_prices[stock].pct_change()

print(daily_pct_change.describe())

Data visualization - Compare the returns of sample firms

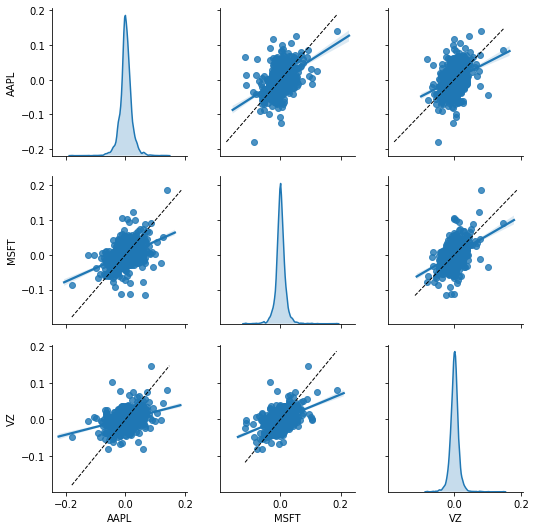

The following figure reports all of the pairwise correlations between the sample firms, along with the distribution of each.

We know from the above table that Apple has the largest mean and standard deviation of the three. The plot type below is useful for seeing if the variables have non-linear relationships, strange outliers, fat tails, or other issues.

# we need this helper function for a plot

def plot_unity(xdata, ydata, **kwargs):

'''

Adds a 45 degree line to the pairplot for plots off the diagonal

Usage:

grid=sns.pairplot( <call pairplot as you want > )

grid.map_offdiag(plot_unity)

'''

mn = min(xdata.min(), ydata.min())

mx = max(xdata.max(), ydata.max())

points = np.linspace(mn, mx, 100)

plt.gca().plot(points, points, color='k', marker=None,

linestyle='--', linewidth=1.0)

# compare the return distribution of 3 firms visually...

grid = sns.pairplot(daily_pct_change,diag_kind='kde',kind="reg")

grid.map_offdiag(plot_unity) # how cool is that!

Factor loadings

A core task in asset pricing is calculating the beta of a stock, along with loadings on other factors. The canonical model is the Fama-French 3 factor model, though 4 and 5 factor models are more popular nowadays.

Merge data on factor loadings with stock return data

We start by grabbing factor returns from Ken French's website, again via pandas API.

ff = pdr.get_data_famafrench('F-F_Research_Data_5_Factors_2x3_daily',start=2006)[0] # the [0] is because the imported obect is a dictionary, and key=0 is the dataframe

ff.rename(columns={"Mkt-RF":"mkt_excess"}, inplace=True) # cleaner name

ff = ff.join(daily_pct_change,how='inner') # merge with stock returns

for stock in ['MSFT','AAPL','VZ']:

ff[stock] = ff[stock] * 100 # FF store variables as percents, so convert to that

ff[stock+'_excess'] = ff[stock] - ff['RF'] # convert to excess returns in prep for regressions

#print(ff.describe()) # ugly...

pd.set_option('display.float_format', lambda x: '%.2f' % x) # show fewer digits

pd.options.display.max_columns = ff.shape[1] # show more columns

print(ff.describe(include = 'all')) # better!

# run the models-

params=pd.DataFrame()

for stock in ['MSFT','AAPL','VZ']:

print('\n\n\n','='*40,'\n',stock,'\n','='*40,'\n')

model = sm.formula.ols(formula = stock+"_excess ~ mkt_excess + SMB + HML", data = ff).fit()

print(model.summary())

params[stock] = model.params.tolist()

params.set_index(model.params.index,inplace=True)

pd.set_option('display.float_format', lambda x: '%.4f' % x) # show fewer digits

print(params)

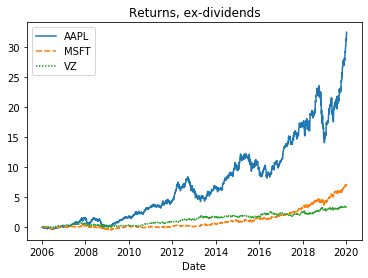

cumrets=(daily_pct_change+1).cumprod()-1

plt.clf() # clear the prior plot before starting a new one

sns.lineplot(data=cumrets).set_title("Returns, ex-dividends")

plt.show(grid)

Lecture flow

Now please go back and finish the lecture.