9.3. Expanding returns¶

Note

The code below might need to be modified to work as of Feb 2023. The fix is here.

9.3.1. The problem¶

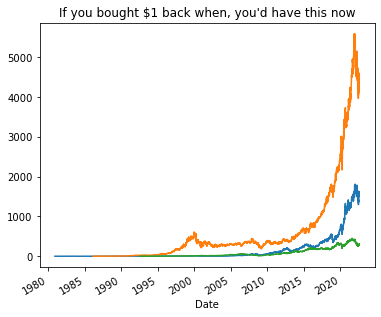

You know the charts that show cumulative returns if you’d bought and held a stock since some long ago date? Let’s make one!

This is called “expanding returns” because you get the total returns from day 0 to day N, then from day 0 to day N+1, and so on; the window is expanding instead of having a fixed number of units or containing a specific increment of time.

9.3.2. Download the returns¶

We need a dataset with firm, date, and the daily return. Let’s build it:

#!pip install pandas_datareader # uncomment and run this ONE TIME ONLY to install pandas data reader

import pandas as pd

import numpy as np

import pandas_datareader as pdr # you might need to install this (see above)

from datetime import datetime

import yfinance as yf

# choose your firms and dates

stocks = ['SBUX','AAPL','MSFT']

start = datetime(1980, 1, 1)

end = datetime(2022, 7, 31)

Tip

The code in the next block is explained more thoroughly in handouts/factor_loading_simple.ipynb in the textbook repo because that file prints the status of the data throughout. Looking at this might help.

# download stock prices

# here, from yahoo: not my fav source, but quick.

# we need to do some data manipulation to get the data ready

stock_prices = yf.download(stocks, start , end)

stock_prices.index = stock_prices.index.tz_localize(None) # change yf date format to match pdr

stock_prices = stock_prices.filter(like='Adj Close') # reduce to just columns with this in the name

stock_prices.columns = stock_prices.columns.get_level_values(1) # tickers as col names, works no matter order of tics

# refmt from wide to long

stock_prices = stock_prices.stack().swaplevel().sort_index().reset_index()

stock_prices.columns = ['Firm','Date','Adj Close']

# add return var = pct_change() function compares to prior row

# EXCEPT: don't compare for first row of one firm with last row of prior firm!

# MAKE SURE YOU CREATE THE VARIABLES WITHIN EACH FIRM - use groupby

stock_prices['ret'] = stock_prices.groupby('Firm')['Adj Close'].pct_change()

stock_prices['ret'] = stock_prices['ret']

stock_prices.head(15)

| Firm | Date | Adj Close | ret | |

|---|---|---|---|---|

| 0 | AAPL | 1980-12-12 | 0.100040 | NaN |

| 1 | AAPL | 1980-12-15 | 0.094820 | -0.052171 |

| 2 | AAPL | 1980-12-16 | 0.087861 | -0.073398 |

| 3 | AAPL | 1980-12-17 | 0.090035 | 0.024751 |

| 4 | AAPL | 1980-12-18 | 0.092646 | 0.028992 |

| 5 | AAPL | 1980-12-19 | 0.098300 | 0.061029 |

| 6 | AAPL | 1980-12-22 | 0.103084 | 0.048670 |

| 7 | AAPL | 1980-12-23 | 0.107434 | 0.042199 |

| 8 | AAPL | 1980-12-24 | 0.113088 | 0.052628 |

| 9 | AAPL | 1980-12-26 | 0.123527 | 0.092310 |

| 10 | AAPL | 1980-12-29 | 0.125267 | 0.014083 |

| 11 | AAPL | 1980-12-30 | 0.122222 | -0.024304 |

| 12 | AAPL | 1980-12-31 | 0.118743 | -0.028468 |

| 13 | AAPL | 1981-01-02 | 0.120048 | 0.010988 |

| 14 | AAPL | 1981-01-05 | 0.117438 | -0.021738 |

9.3.3. Getting the expanding returns¶

Notice that this dataset has the simple return for a period, not the gross returns (defined here).

To compute \(R_i[0,T]\) for all firms \(i\) and each time \(T\) in the dataset, you’re going to need to use groupby. You have two equivalent options from there:

For each firm, get the

cumprod()of the gross return over its time series.df.assign(R=1+df['r']).groupby('firm')['R'].cumprod()

For each firm, take the product of \(1+r\) for all prior periods using the expanding window functionality.

df.groupby('firm')['r'].expanding().apply(lambda x: np.prod(1+x))

Which you choose is up to you, but in my testing, the cumprod approach is 2.5x faster.

stock_prices['cumret'] = \

(

stock_prices

.assign(ret=1+stock_prices['ret'])

.groupby('Firm')

['ret']

.cumprod()

)

9.3.4. Plotting the total returns¶

If only we could turn back time.

(stock_prices.set_index('Date').groupby('Firm')['cumret']

.plot(title="If you bought $1 back when, you'd have this now",

figsize=(6,5))

);