9.6. Is signal X useful in predicting returns?¶

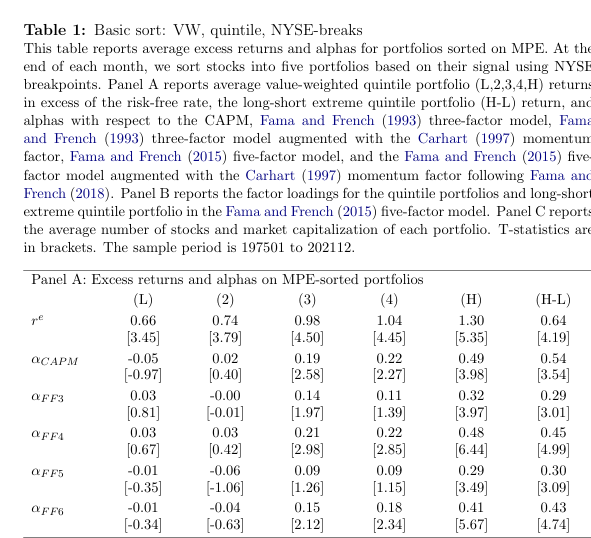

In many “cross-sectional” asset pricing papers, the main results are shown in Table 1, and show whether we can form portfolios that generate alpha using some signal (a variable that describes something about stocks) to sort stocks into portfolios.

To make this analysis more rigorous, we can measure alpha six different ways (against six different asset pricing models). Among these are the CAPM and FF3 models we just estimated in prior pages.

The basic idea of this kind of table is that

We measure something about stocks. Maybe it’s their size, or their recent returns. Let’s call this variable X.

Then we sort stocks on X every month and divide them into 5 or 10 buckets. The stocks in each bucket constitute a portfolio, so we get the returns for that bucket for the next month. We also compute the “Long-Short” portfolio, which is always the return of the highest bucket minus the lowest bucket. The long-short portfolio is what you would get if you short the stocks in the lowest bucket to go long the highest bucket, and are “zero cost” portfolios.

We repeat this across time so we can see how each portfolio/bucket does and show the average return in each bucket.

To be more sophisticated, we do step 3 a few ways: We look at the portfolio returns compared to the market, and we also compute the portfolio alphas against some benchmark factor models.

If we see significant results in the High Minus Low column, practitioners will say that X is an “anomaly”, in that the asset pricing model can’t explain its returns.

The plan for this code file comes from the “Assaying Anomalies” project, which is a protocol to evaluate whether a given factor X is useful in predicting returns.

Here is the repo containing that project’s code (mostly in Matlab as of Spring 2025, but will be in Python soon).

The paper describing that project, which you should read (it is breezy), and what you should cite is: Novy-Marx, Robert and Velikov, Mihail, Assaying Anomalies (February 13, 2024). Available at SSRN: https://ssrn.com/abstract=4338007 or http://dx.doi.org/10.2139/ssrn.4338007

If you want to go beyond the Table 1 we output here, the next things you should output are precisely what Velikov and Novy-Marx show in their paper after Table 1.

9.6.1. What “Table 1” looks like¶

In our code below, we are trying to replicate the structure of this table below, from Novy-Marx and Velikov.

# !pip install pandas-datareader # run this once, then comment

import pandas_datareader.famafrench as ff

import pandas as pd

import numpy as np

import statsmodels.api as sm

import statsmodels.formula.api as smf

import warnings

warnings.simplefilter(action="ignore", category=FutureWarning)

# datasets = ff.get_available_datasets()

# datasets

9.6.2. Step 1: Get the factor portfolio returns.¶

df_factors = ff.FamaFrenchReader('F-F_Research_Data_5_Factors_2x3', start='1900-01-01').read()[0]

# add momentum to this

mom = ff.FamaFrenchReader('F-F_Momentum_Factor', start='1900-01-01').read()[0] # add momentum

mom.columns = ['Mom'] # rename

df_factors = pd.merge(df_factors, mom, left_index=True, right_index=True)

df_factors # FYI: contains Mkt-RF and RF, but no Mkt

| Mkt-RF | SMB | HML | RMW | CMA | RF | Mom | |

|---|---|---|---|---|---|---|---|

| Date | |||||||

| 1963-07 | -0.39 | -0.41 | -0.97 | 0.68 | -1.18 | 0.27 | 0.90 |

| 1963-08 | 5.07 | -0.80 | 1.80 | 0.36 | -0.35 | 0.25 | 1.01 |

| 1963-09 | -1.57 | -0.52 | 0.13 | -0.71 | 0.29 | 0.27 | 0.19 |

| 1963-10 | 2.53 | -1.39 | -0.10 | 2.80 | -2.01 | 0.29 | 3.12 |

| 1963-11 | -0.85 | -0.88 | 1.75 | -0.51 | 2.24 | 0.27 | -0.74 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-08 | 1.61 | -3.65 | -1.13 | 0.85 | 0.86 | 0.48 | 4.79 |

| 2024-09 | 1.74 | -1.02 | -2.59 | 0.04 | -0.26 | 0.40 | -0.60 |

| 2024-10 | -0.97 | -0.88 | 0.89 | -1.38 | 1.03 | 0.39 | 2.87 |

| 2024-11 | 6.51 | 4.78 | -0.05 | -2.62 | -2.17 | 0.40 | 0.90 |

| 2024-12 | -3.17 | -3.87 | -2.95 | 1.82 | -1.10 | 0.37 | 0.05 |

738 rows × 7 columns

9.6.3. Step 2: Construct portfolio returns from your signal¶

Above, we said that

We measure something about stocks. Maybe it’s their size, or their recent returns. Let’s call this variable X.

Then we sort stocks on X every month and divide them into 5 or 10 buckets. The stocks in each bucket constitute a portfolio, so we get the returns for that bucket for the next month. We also compute the “Long-Short” portfolio, which is always the return of the highest bucket minus the lowest bucket. The long-short portfolio is what you would get if you short the stocks in the lowest bucket to go long the highest bucket, and are “zero cost” portfolios.

This is where you would do that.

For simplicity, I’m just using pre-constructed portfolio returns on this page. To see one way to construct a signal from predictor variables and how we calculate the portfolio returns, visit the page on trading on stock return predictions.

# now, here we'd develop some "signal" and then create portfolio rets based on it

# I'm skipping... you figure that out

# I'll pretend I did that by grabbing 5 industry portfolio returns

df_portfolios = ff.FamaFrenchReader('5_Industry_Portfolios', start='1900-01-01').read()[0]

df_portfolios.columns = [f'Port{i+1}' for i in range(len(df_portfolios.columns))] # this is my anticipated portfolio number name scheme

df_portfolios.eval("HmL = Port5-Port1", inplace=True)

# Make each portfolio (except for HmL) excess returns

for col in ['Port1', 'Port2', 'Port3', 'Port4', 'Port5']:

df_portfolios[col] = df_portfolios[col] - df_factors['RF']

portfolios = df_portfolios.columns.tolist()

df_portfolios

9.6.4. Step 3: Run the regressions.¶

reg_df = pd.merge(df_factors, df_portfolios, left_index=True, right_index=True)

reg_df

| Mkt-RF | SMB | HML | RMW | CMA | RF | Mom | Port1 | Port2 | Port3 | Port4 | Port5 | HmL | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||||

| 1975-01 | 13.66 | 12.91 | 8.28 | -0.78 | -0.90 | 0.58 | -13.82 | 21.19 | 11.94 | 12.90 | -1.32 | 17.31 | -3.88 |

| 1975-02 | 5.56 | -0.65 | -4.45 | 1.16 | -2.11 | 0.43 | -0.61 | 4.23 | 4.63 | 9.34 | 15.61 | 2.44 | -1.79 |

| 1975-03 | 2.66 | 4.00 | 2.38 | 1.26 | -1.33 | 0.41 | -2.04 | 7.75 | 1.40 | -0.17 | 0.88 | 3.74 | -4.01 |

| 1975-04 | 4.23 | -0.71 | -1.14 | 1.41 | -1.34 | 0.44 | 1.38 | 2.75 | 6.82 | 2.53 | 0.21 | 2.83 | 0.08 |

| 1975-05 | 5.19 | 2.89 | -4.10 | -0.98 | -0.60 | 0.44 | -0.58 | 3.60 | 5.95 | 4.56 | 6.08 | 5.28 | 1.68 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-08 | 1.61 | -3.65 | -1.13 | 0.85 | 0.86 | 0.48 | 4.79 | 0.57 | 0.70 | 0.86 | 5.96 | 2.55 | 1.98 |

| 2024-09 | 1.74 | -1.02 | -2.59 | 0.04 | -0.26 | 0.40 | -0.60 | 4.01 | 1.54 | 2.69 | -2.21 | 0.26 | -3.75 |

| 2024-10 | -0.97 | -0.88 | 0.89 | -1.38 | 1.03 | 0.39 | 2.87 | -2.08 | -2.38 | -0.48 | -3.50 | 0.72 | 2.80 |

| 2024-11 | 6.51 | 4.78 | -0.05 | -2.62 | -2.17 | 0.40 | 0.90 | 10.52 | 6.01 | 4.76 | -0.98 | 9.83 | -0.69 |

| 2024-12 | -3.17 | -3.87 | -2.95 | 1.82 | -1.10 | 0.37 | 0.05 | -0.82 | -8.38 | 0.56 | -5.79 | -7.46 | -6.64 |

600 rows × 13 columns

# define factor model formulas (these are the right side of the regression formulas)

# these are how formulas are specified for statsmodel's formula api

factor_models = {

'r^e': '1',

'CAPM': 'Q("Mkt-RF")',

'FF3': 'Q("Mkt-RF") + SMB + HML',

'FF4': 'Q("Mkt-RF") + SMB + HML + Mom',

'FF5': 'Q("Mkt-RF") + SMB + HML + RMW + CMA',

'FF6': 'Q("Mkt-RF") + SMB + HML + RMW + CMA + Mom'

}

# pre built output table

index = pd.MultiIndex.from_product([factor_models.keys(), ['alpha', 't-stat']], names=['Model', 'Metric'])

results = pd.DataFrame(index=index, columns=portfolios, dtype=float)

results

| Port1 | Port2 | Port3 | Port4 | Port5 | HmL | ||

|---|---|---|---|---|---|---|---|

| Model | Metric | ||||||

| r^e | alpha | NaN | NaN | NaN | NaN | NaN | NaN |

| t-stat | NaN | NaN | NaN | NaN | NaN | NaN | |

| CAPM | alpha | NaN | NaN | NaN | NaN | NaN | NaN |

| t-stat | NaN | NaN | NaN | NaN | NaN | NaN | |

| FF3 | alpha | NaN | NaN | NaN | NaN | NaN | NaN |

| t-stat | NaN | NaN | NaN | NaN | NaN | NaN | |

| FF4 | alpha | NaN | NaN | NaN | NaN | NaN | NaN |

| t-stat | NaN | NaN | NaN | NaN | NaN | NaN | |

| FF5 | alpha | NaN | NaN | NaN | NaN | NaN | NaN |

| t-stat | NaN | NaN | NaN | NaN | NaN | NaN | |

| FF6 | alpha | NaN | NaN | NaN | NaN | NaN | NaN |

| t-stat | NaN | NaN | NaN | NaN | NaN | NaN |

# Run regressions for each portfolio and model

full_reg_output = {} # to save everything, in case we want to access other stuff (like beta loadings)

for portfolio in portfolios:

for model_name, formula in factor_models.items():

reg = smf.ols(formula=f'{portfolio} ~ {formula}', data=reg_df).fit()

# extract the intercept coef and t-stat

alpha = reg.params['Intercept']

t_stat = reg.tvalues['Intercept']

results.at[(model_name, 'alpha'), portfolio] = alpha

results.at[(model_name, 't-stat'), portfolio] = t_stat

full_reg_output[(model_name, portfolio)] = reg

results

| Port1 | Port2 | Port3 | Port4 | Port5 | HmL | ||

|---|---|---|---|---|---|---|---|

| Model | Metric | ||||||

| r^e | alpha | 0.661057 | 0.557900 | 0.646938 | 0.681369 | 0.597724 | -0.063333 |

| t-stat | 3.900987 | 3.433497 | 3.230902 | 3.859817 | 3.052126 | -0.647961 | |

| CAPM | alpha | 0.114768 | 0.038745 | 0.010464 | 0.203102 | -0.043658 | -0.158426 |

| t-stat | 1.630695 | 0.550711 | 0.118044 | 1.773375 | -0.584753 | -1.670608 | |

| FF3 | alpha | 0.091171 | -0.052544 | 0.137807 | 0.302106 | -0.186326 | -0.277498 |

| t-stat | 1.290888 | -0.815539 | 1.721098 | 2.730282 | -3.023698 | -3.132967 | |

| FF4 | alpha | 0.124516 | -0.093283 | 0.208553 | 0.235236 | -0.152898 | -0.277413 |

| t-stat | 1.733414 | -1.427806 | 2.585315 | 2.095277 | -2.442501 | -3.067951 | |

| FF5 | alpha | -0.074883 | -0.184758 | 0.318594 | 0.133618 | -0.180963 | -0.106080 |

| t-stat | -1.142738 | -2.948850 | 4.167975 | 1.209001 | -2.945735 | -1.222041 | |

| FF6 | alpha | -0.032642 | -0.206952 | 0.362788 | 0.093130 | -0.155887 | -0.123244 |

| t-stat | -0.496089 | -3.265914 | 4.717103 | 0.833356 | -2.511528 | -1.400810 |