9.3. Expanding returns¶

9.3.1. The problem¶

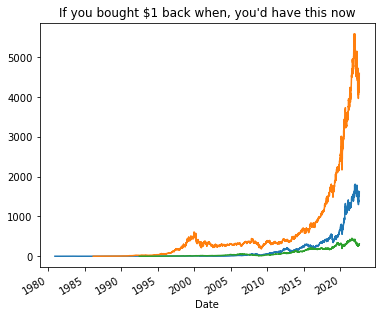

You know the charts that show cumulative returns if you’d bought and held a stock since some long ago date? Let’s make one!

This is called “expanding returns” because you get the total returns from day 0 to day N, then from day 0 to day N+1, and so on; the window is expanding instead of having a fixed number of units or containing a specific increment of time.

9.3.2. Download the returns¶

We need a dataset with firm, date, and the daily return. Let’s build it:

#!pip install pandas_datareader # uncomment and run this ONE TIME ONLY to install pandas data reader

import pandas as pd

import numpy as np

import pandas_datareader as pdr # you might need to install this (see above)

from datetime import datetime

import yfinance as yf

# choose your firms and dates

stocks = ['SBUX','AAPL','MSFT']

start = datetime(1980, 1, 1)

end = datetime(2022, 7, 31)

Tip

The code in the next block is explained more thoroughly in handouts/factor_loading_simple.ipynb in the textbook repo because that file prints the status of the data throughout. Looking at this might help.

# download stock prices

# here, from yahoo: not my fav source, but quick.

# we need to do some data manipulation to get the data ready

stock_prices = yf.download(stocks, start , end)

stock_prices.index = stock_prices.index.tz_localize(None) # change yf date format to match pdr

stock_prices = stock_prices.filter(like='Adj Close') # reduce to just columns with this in the name

stock_prices.columns = stock_prices.columns.get_level_values(1) # tickers as col names, works no matter order of tics

# refmt from wide to long

stock_prices = stock_prices.stack().swaplevel().sort_index().reset_index()

stock_prices.columns = ['Firm','Date','Adj Close']

# add return var = pct_change() function compares to prior row

# EXCEPT: don't compare for first row of one firm with last row of prior firm!

# MAKE SURE YOU CREATE THE VARIABLES WITHIN EACH FIRM - use groupby

stock_prices['ret'] = stock_prices.groupby('Firm')['Adj Close'].pct_change()

stock_prices['ret'] = stock_prices['ret']

stock_prices.head(15)

| Firm | Date | Adj Close | ret | |

|---|---|---|---|---|

| 0 | AAPL | 1980-12-12 | 0.100040 | NaN |

| 1 | AAPL | 1980-12-15 | 0.094820 | -0.052171 |

| 2 | AAPL | 1980-12-16 | 0.087861 | -0.073398 |

| 3 | AAPL | 1980-12-17 | 0.090035 | 0.024751 |

| 4 | AAPL | 1980-12-18 | 0.092646 | 0.028992 |

| 5 | AAPL | 1980-12-19 | 0.098300 | 0.061029 |

| 6 | AAPL | 1980-12-22 | 0.103084 | 0.048670 |

| 7 | AAPL | 1980-12-23 | 0.107434 | 0.042199 |

| 8 | AAPL | 1980-12-24 | 0.113088 | 0.052628 |

| 9 | AAPL | 1980-12-26 | 0.123527 | 0.092310 |

| 10 | AAPL | 1980-12-29 | 0.125267 | 0.014083 |

| 11 | AAPL | 1980-12-30 | 0.122222 | -0.024304 |

| 12 | AAPL | 1980-12-31 | 0.118743 | -0.028468 |

| 13 | AAPL | 1981-01-02 | 0.120048 | 0.010988 |

| 14 | AAPL | 1981-01-05 | 0.117438 | -0.021738 |

9.3.3. Getting the expanding returns¶

Notice that this dataset has the simple return for a period, not the gross returns (defined here).

To compute \(R_i[0,T]\) for all firms \(i\) and each time \(T\) in the dataset, you’re going to need to use groupby. You have two equivalent options from there:

For each firm, get the

cumprod()of the gross return over its time series.df.assign(R=1+df['r']).groupby('firm')['R'].cumprod()

For each firm, take the product of \(1+r\) for all prior periods using the expanding window functionality.

df.groupby('firm')['r'].expanding().apply(lambda x: np.prod(1+x))

Which you choose is up to you, but in my testing, the cumprod approach is 2.5x faster.

stock_prices['cumret'] = \

(

stock_prices

.assign(ret=1+stock_prices['ret'])

.groupby('Firm')

['ret']

.cumprod()

)

9.3.4. Plotting the total returns¶

If only we could turn back time.

(stock_prices.set_index('Date').groupby('Firm')['cumret']

.plot(title="If you bought $1 back when, you'd have this now",

figsize=(6,5))

);